Employer-dependent advances may perhaps charge service fees, Nevertheless they tend to be lessen than cash advance app charges and companies might protect them. Gained wage accessibility corporations just take as much as a couple of days to supply cash, which can be on par with cash advance applications.

Before applying for any $one,000 financial loan, make evaluation your credit report and study your present credit rating. This will provide you with an concept of what financial loans you may perhaps qualify for and enable you to avoid unnecessary really hard inquiries on the credit score report. You could request a free duplicate of your credit report by browsing .

Prior to deciding to use, you'll want to read through and understand the conditions and terms of the personal loan. Confirm exactly how much dollars that you are borrowing, just how much you might get, as well as the charges the lender costs when having out a loan. Read through the mortgage arrangement to learn more concerning the interest fee and repayment conditions.

Since cash advances come with high charges and raise your credit score utilization, you might want to take a look at alternatives. Here are a few to contemplate:

Noncustomers can probable find a far better deal, nevertheless. Consumers could also defer a scheduled repayment date up to 2 weeks, that is uncommon for the cash advance app.

Being aware of how quickly you could get cash just after approval is crucial should you find yourself in a tight cash crunch. If the lender’s disbursement program doesn’t match your fiscal wants, implementing for just a $one,000 similar working day mortgage with a unique lender may work.

Instacash can be a 0% APR cash advance support supplied by MoneyLion. Your obtainable Instacash advance Restrict is going to be displayed to you while in the MoneyLion cell application and should transform every now and then. Your limit will probably be dependant on your direct deposits, account transaction background, along with other elements as based on MoneyLion. This service has no obligatory costs. You may go away an optional tip and pay back an optional Turbo Payment for expedited funds shipping and delivery.

Check out more home shopping for resourcesGet pre-approved for a mortgageHome affordabilityFirst-time homebuyers guideDown paymentHow A lot am i able to borrow home finance loan calculatorInspections and appraisalsMortgage lender opinions

Most lenders have simple necessities to qualify for the financial loan. Right before making use of for an internet based loan, Verify with the lender to ensure you are qualified to apply. One example is, most lenders have to have the borrower for being at least eighteen yrs old along with a U.

Payday financial loans are small-time period remedies with large prices and no credit rating checks. They're distinctive from personalized financial loans since the interest premiums are much larger, and the charges can substantially increase the amount you owe.

Be sure to Notice that by clicking Continue underneath, you might go away Lendly, LLC’s Web-site. Lendly, LLC won't possess or work this website and so can not make sure its material.

This class assesses how perfectly an application assists borrowers steer clear of borrowing an advance that will overextend their funds. A client-initial cash advance app critiques much more than a few months of borrowers’ bills, involves normal banking account deposits and lets borrowers opt for the amount of to borrow.

Very low-fascination financial loans for terrible credit rating are rare but probable. Secured financial loans could give lessen charges should you can provide collateral. Credit score unions could even have options for users with bad credit history at realistic premiums.

On the repayment day, the application get more info checks your account harmony to make certain there’s adequate for repayment and withdraws the money.

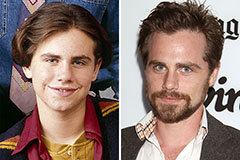

Rider Strong Then & Now!

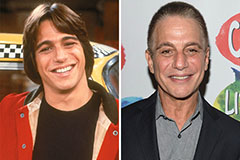

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!